How to Obtain Your 1098-T

- Navigate to: https://finadmin.lafayette.edu/pay-bill

- Select to log in through the Student or Authorized User link.

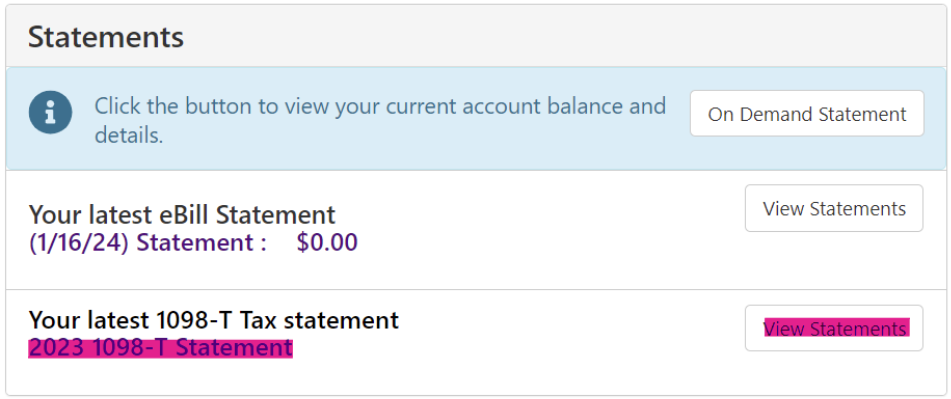

- After logging in, find the “My Statements” link on the right-side of the homepage.

No Electronic Consent

Students who do not consent to receive the form electronically are mailed a physical 1098T tax statement.

Graduates or Non-Current Students

Lafayette graduates must retrieve their 1098T forms from Heartland ECSI directly. Please follow the steps found here to create an ECSI account to access your 1098T.

W-9S Social Security Tax Form

Please use this link to provide your W-9S to Lafayette College.

Other 1098-T Information

The Internal Revenue Service (IRS) requires the College to issue a 1098-T to any student enrolled during the calendar year, except for:

- Nonresident alien students, unless requested by the student;

- Students whose qualified tuition and related expenses are entirely waived or paid entirely with scholarships; and

- Students for whom you do not maintain a separate financial account and whose qualified tuition and related expenses are covered by a formal billing arrangement between an institution and the student’s employer or a governmental entity, such as the Department of Veterans Affairs or the Department of Defense

Frequently Asked Questions

Please click here to see Frequently Asked Questions regarding form 1098-T and the change to Box 1 reporting.